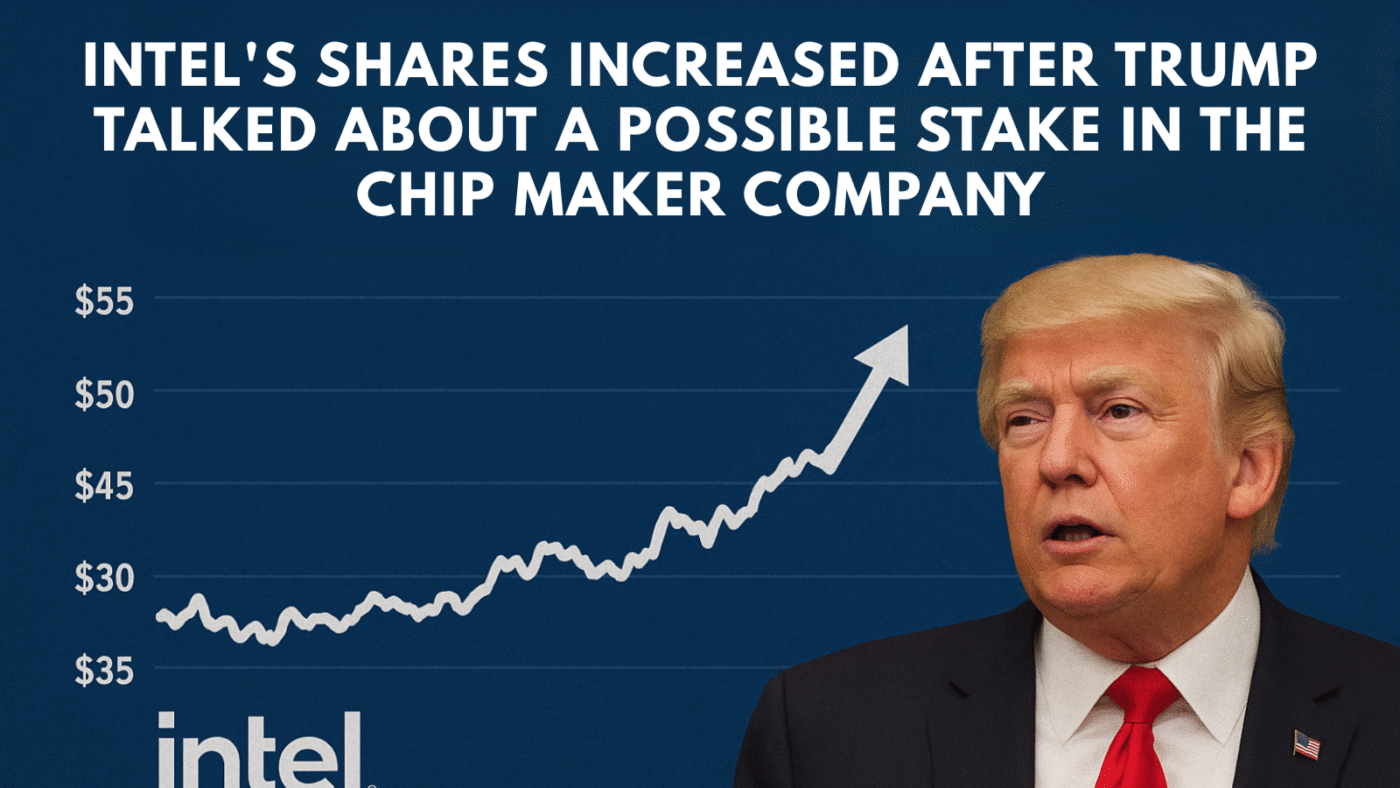

Following reports that the Trump administration is considering purchasing stock in the faltering U.S. chip giant, Intel shares increased by almost 4% at the beginning of Friday’s trading session. This move could potentially transform the nation’s semiconductor industry.

Bloomberg, which broke the story first and quoted people with knowledge of the discussions, claimed that the US government could invest directly in Intel using the $52 billion in CHIPS Act funds. In order to boost domestic chipmaking, President Joe Biden signed the CHIPS Act into law in 2022.

Last year, this program gave Intel the single largest award under the law—nearly $8 billion—to construct new factories in Ohio and other states. However, under current CEO Lip-Bu Tan, who has backed away from the ambitious expansion plans supported by his predecessor, Pat Gelsinger, the progress has been beset by delays and cost-cutting.

Reduce Financial Stress

Federal assistance could alleviate Intel’s current financial strains, but it won’t eliminate the challenging road ahead. The business, which was once the clear leader in chip technology, is having trouble catching up to its competitors.

AMD is gaining market share in both PCs and data centers, Nvidia is gaining market share in artificial intelligence (AI), and Taiwan’s TSMC is gaining market share in precision manufacturing. Its latest manufacturing technology, called “18A,” is also experiencing problems, and production capacity is falling, according to an earlier report from Reuters

Still, analysts believe U.S. government ownership could give Intel more time to turn its foundry business, which makes chips for other businesses, into a viable venture. According to equity analyst Matt Britzman, “Government support could help boost confidence, but it doesn’t overcome the lack of inherent competitiveness in advanced nodes.” However, Britzman says it could change the entire situation.

Meanwhile, the White House has downplayed the reports as “speculative.” Spokesman Kush Desai said any discussion of potential deals should be treated as speculation until the administration makes an official announcement.

While Intel declined to comment directly, it reiterated its “deep commitment to support President Trump’s efforts to strengthen American technology and manufacturing leadership.”

Wall Street was immediately excited by the news, even in spite of the denials; Intel’s stock increased more than 7% on Thursday, and the company’s market value increased to about $104 billion. After a terrible 2024 in which Intel lost almost 60% of its value before recovering a 19% gain this year, that is a welcome turnaround for investors.

The announcement follows President Donald Trump’s meeting with CEO Lip-Bu Tan at the White House, which took place just days after the president publicly demanded Tan’s resignation due to Tan’s alleged ties to Chinese tech companies.

Interesting move! Intel shares jump after the U.S. government takes a 10% stake.

Intel shares surged after the U.S. government announced a 10% stake, highlighting strong support for domestic semiconductor production. Investors are optimistic, seeing potential growth. This rare government involvement in a private company could reshape the semiconductor industry significantly.

Intel’s stock jumped following the announcement of a 10% U.S. government stake. This bold move signals confidence in domestic semiconductor growth. Investors are optimistic, and it’s intriguing to see how this historic intervention will influence Intel and the broader tech industry.

It’s fascinating how a single person acquiring a stake in a company can boost its stock value. Investor confidence can surge simply based on who holds ownership, showing the power of perception in the market.